How to Prevent Fraud: Financial Documents

Fraud is everywhere, leading to more digital documentation and less documented on paper. As convenient as this is, there are still some documentation that we receive in the mail or at work that has our personal data on it but we think nothing of it. This personal data could be essential to our identity, which is why we need to protect it. According to the Insurance Information Institute, in America, 12% of people are a victim of Bank fraud and in Missouri alone, 820,000 of the population were a victim to identity theft.

Top Financial Documents to Destroy to Prevent Fraud

To commit fraud, a hacker or identity thief would only need your name, DOB, phone number and/or address. With that information alone they can create new credit cards, a new identity, file fraudulent tax returns and more. To protect your financial status and prevent fraud, here are the top financial documents to destroy.

1. Bank Statements and Pay stubs

Though it may seem that bank statements and pay stubs are harmless, it still contains your name, address, possibly your bank account number ( either partial or whole number) and how much money you have in your account. These are all things that hackers can easily impersonate you with if it fell into the wrong hands. Your pay stub could also contain your social security number. These items should definitely be in your shred pile.

2. Credit/Debit Cards and Credit/Debit Card Numbers

How many of us have cut up our credit card with scissors, threw it in the trash and called it good? Well, it’s not very good. Compromised cards are often those that are put back together . It can contain your card number, your name and possibly your address. Decrease risks of credit card fraud by shredding them.

3. Old Tax Returns

Shredding your old tax returns is the best way to prevent tax fraud. Throwing away your tax returns can put you at high risk of fraud with information like your social security number, address, name, income and place of employment all on one paper. If someone stole your information they could apply for credit cards, open up bank accounts, apply for a tax return under your name, etc.

4. Junk Mail

Junk mail may be junk to you but a gold mine to an identity thief. If you’re currently throwing away credit card offers or loan offers that comes in the mail, you could be putting yourself at risk. If that junk mail got into the wrong hands, someone could open up an account in your name.

5. Canceled/Voided Checks

Have you ever seen the movie Blank Check? How often do you void a check? What do you do with it afterwards? Do you throw it away or leave it laying around the house? Voided checks are an easy way for someone to access your routing number and account number. Your name and address could also be on that check making it a high risk item for identity theft. If you write a check, make sure you’re writing a check to a trusted source or pay cash, if possible.

6. ATM receipts

Although these little things like to fly out of your car window, they are just as important as any other financial document. If fallen in the wrong hands you could be at high risk of identity theft. Account numbers and routing numbers are often exposed which makes it important to keep a tight grip on ATM receipts.

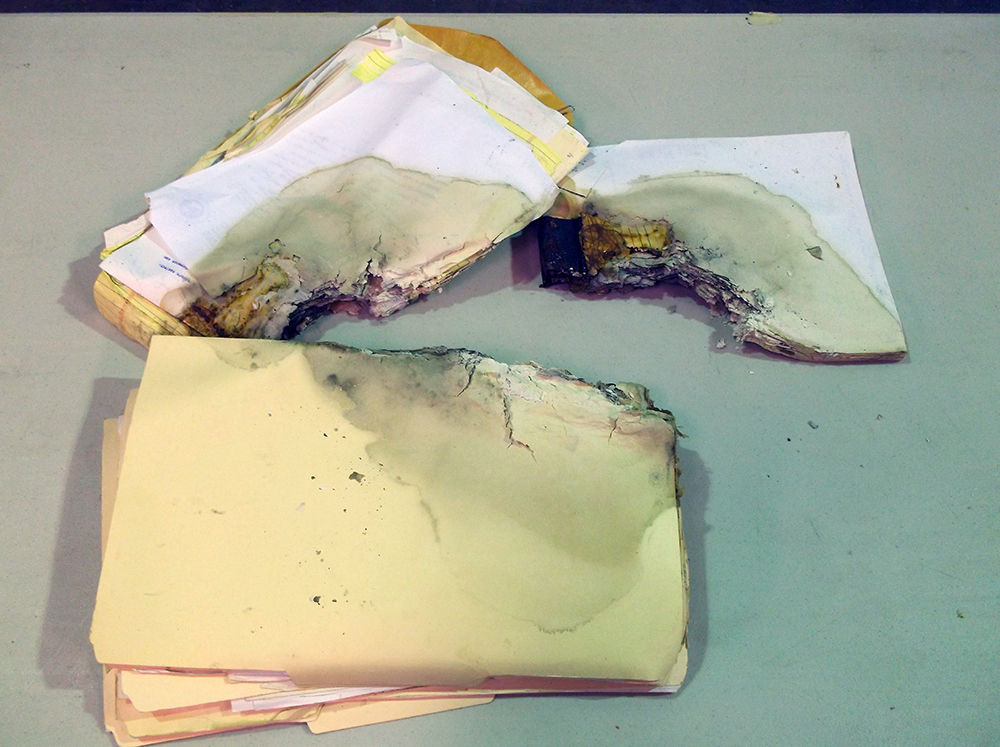

What have we learned from this? When in doubt, shred! If your name, address and phone number is on it, shred it. If your bank account information is on it, shred it! What better company could you ask to shred your documents besides Access Records Management? We take pride in making sure your documents are safe and we like to provide our customers with the knowledge they need to keep their documents safe.

Are you storing records and data with a national document management company and the service fees continue to soar higher than the tallest mountain?

Are you storing records and data with a national document management company and the service fees continue to soar higher than the tallest mountain?